Frost Pllc Can Be Fun For Everyone

Frost Pllc Can Be Fun For Everyone

Blog Article

Frost Pllc Can Be Fun For Anyone

Table of ContentsNot known Facts About Frost PllcNot known Details About Frost Pllc The Facts About Frost Pllc UncoveredThe smart Trick of Frost Pllc That Nobody is DiscussingSome Ideas on Frost Pllc You Need To Know

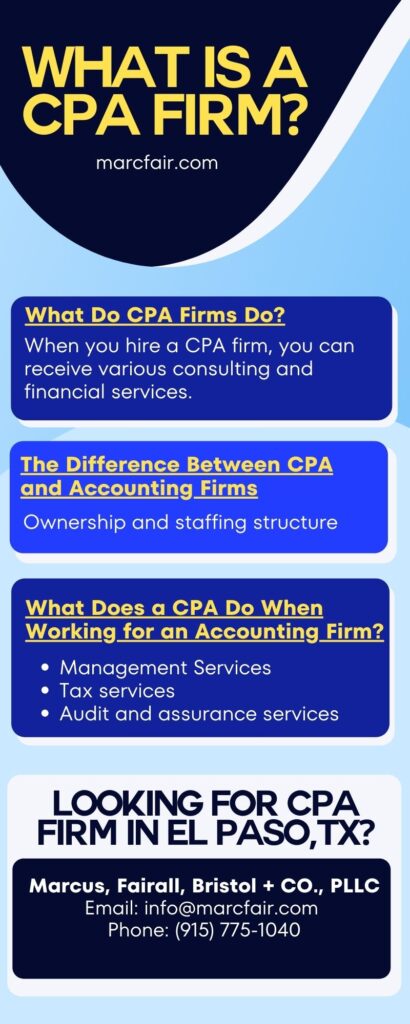

Certified public accountants are among the most trusted careers, and forever reason. Not just do Certified public accountants bring an unequaled degree of knowledge, experience and education to the procedure of tax obligation planning and managing your cash, they are specifically educated to be independent and objective in their work. A CPA will help you secure your rate of interests, pay attention to and resolve your worries and, just as crucial, give you comfort.In these defining moments, a CPA can use greater than a general accounting professional. They're your trusted advisor, guaranteeing your business remains economically healthy and lawfully shielded. Employing a regional CPA company can positively affect your organization's economic wellness and success. Here are 5 essential benefits. A neighborhood certified public accountant company can assist decrease your business's tax obligation problem while guaranteeing compliance with all suitable tax obligation legislations.

This growth mirrors our dedication to making a favorable impact in the lives of our customers. Our commitment to quality has actually been acknowledged with numerous honors, including being called one of the 3 Best Bookkeeping Firms in Salt Lake City, UT, and Best in Northern Utah 2024. When you function with CMP, you enter into our family members.

The Buzz on Frost Pllc

Jenifer Ogzewalla I've functioned with CMP for numerous years now, and I've actually appreciated their know-how and performance. When auditing, they work around my routine, and do all they can to maintain continuity of personnel on our audit.

Right here are some key concerns to lead your choice: Examine if the CPA holds an energetic permit. This guarantees that they have passed the required examinations and fulfill high moral and specialist standards, and it shows that they have the certifications to handle your economic issues sensibly. Confirm if the certified public accountant offers solutions that align with your service demands.

Tiny services have unique economic needs, and a CPA with pertinent experience can offer even more tailored advice. Ask about their experience in your market or with companies of your dimension to guarantee they recognize your certain difficulties.

Clear up how and when you can reach them, and if they use routine updates or appointments. An easily accessible and receptive CPA will certainly be invaluable for prompt decision-making and assistance. Employing a regional CPA firm is more than simply contracting out financial tasksit's a clever financial investment in your company's future. At CMP, with offices in Salt Lake City, Logan, and St.

A Biased View of Frost Pllc

An accountant that has passed the CPA examination can represent you prior to the IRS. Certified public accountants are certified, accounting experts. CPAs might help themselves or as component of a company, depending on the setting. The expense of tax obligation prep work may be reduced for independent professionals, but their proficiency and capacity may be much less.

About Frost Pllc

Handling this responsibility can be a frustrating task, and doing something incorrect can cost you both monetarily and reputationally (Frost PLLC). Full-service certified public accountant companies recognize with filing needs to ensure your organization follow government and state legislations, along with those of financial institutions, capitalists, and others. You might need to report extra revenue, which may need you to file an income tax return for the very first time

group you can trust. Contact us for additional information regarding our solutions. Do you comprehend the accountancy cycle and the actions associated with guaranteeing correct monetary check my reference oversight of your organization's financial health? What is your company 's legal structure? Sole proprietorships, C-corps, S firms and partnerships are tired in a different way. The even more complicated your income resources, locations(interstate or global versus local )and market, the extra you'll need a CPA. CPAs have much more education and learning and undergo a strenuous accreditation procedure, so they cost greater than a tax preparer or bookkeeper. Generally, tiny businesses pay between$1,000 and $1,500 to employ a CPA. When margins are tight, this cost may beout of reach. The months before tax obligation day, April 15, are the busiest season for Certified public accountants, complied with by the months prior to completion of the year. You might have to wait to get your concerns answered, and your income tax return might take longer to finish. There is a minimal number of CPAs to walk around, so you might have a difficult time discovering one specifically if you have actually waited until the last minute.

Certified public accountants are the" large guns "of the bookkeeping market and normally don't handle day-to-day accountancy jobs. Often, these other types of accounting professionals have specializeds throughout locations where having a Certified public accountant license isn't called for, such as administration bookkeeping, nonprofit bookkeeping, price audit, federal government accountancy, or audit. As an outcome, utilizing an audit services business is often a much better value than working with a CERTIFIED PUBLIC ACCOUNTANT

firm to company your ongoing financial continuous economicMonitoring

Brickley Riches Monitoring is a Registered Financial Investment Consultant *. Advisory solutions are just provided to clients or prospective customers where Brickley Wide range Monitoring and its agents are correctly certified or excluded from licensure. The details throughout this internet site is exclusively for informative functions. The content is developed from resources thought to give exact info, and we conduct reasonable due diligence testimonial

nevertheless, the details contained throughout this website is subject to transform without notification and is not without error. Please consult your financial investment, tax, or lawful advisor for support concerning your specific circumstance. Brickley Riches Administration does not offer lawful suggestions, and nothing in this internet site will be understood as lawful guidance. To find out more on our company discover this and our advisors, please see the current Kind ADV and Component 2 Brochures and our Customer Connection Summary. The not-for-profit board, or board of supervisors, is the legal controling body of a not-for-profit company. The members of a not-for-profit board are accountable for comprehending and enforcing the legal requirements of a company. They additionally concentrate on the top-level method, oversight, and accountability of the organization. While there are many candidates deserving of joining a board, a CPA-certified accounting professional brings a special skillset with them and can function as a useful resource for your not-for-profit. This direct experience gives them insight into the practices and techniques of a strong managerial group that they can then show the board. CPAs likewise have knowledge in developing and refining business policies and procedures and analysis of the useful demands of staffing models. This provides the unique skillset to assess administration teams and provide referrals. Secret to this is the capability to recognize and interpret the nonprofits'annual financial statements, which offer understandings into exactly how an organization creates profits, just how much it costs the company useful link to run, and exactly how efficiently it handles its donations. Typically the financial lead or treasurer is charged with managing the budgeting, forecasting, and evaluation and oversight of the economic details and monetary systems. One of the advantages of being an accountant is working closely with members of various companies, including C-suite execs and various other decision manufacturers. A well-connected CPA can take advantage of their network to help the company in different calculated and getting in touch with roles, effectively connecting the company to the excellent prospect to accomplish their requirements. Next time you're wanting to fill up a board seat, think about reaching out to a CPA that can bring worth to your organization in all the means listed above. Wish to find out more? Send me a message. Clark Nuber PS, 2022.

Report this page